California’s Gas Price Crisis

More Fees, More Taxes, More Excuses: The Truth Behind California’s Exorbitant Fuel Prices

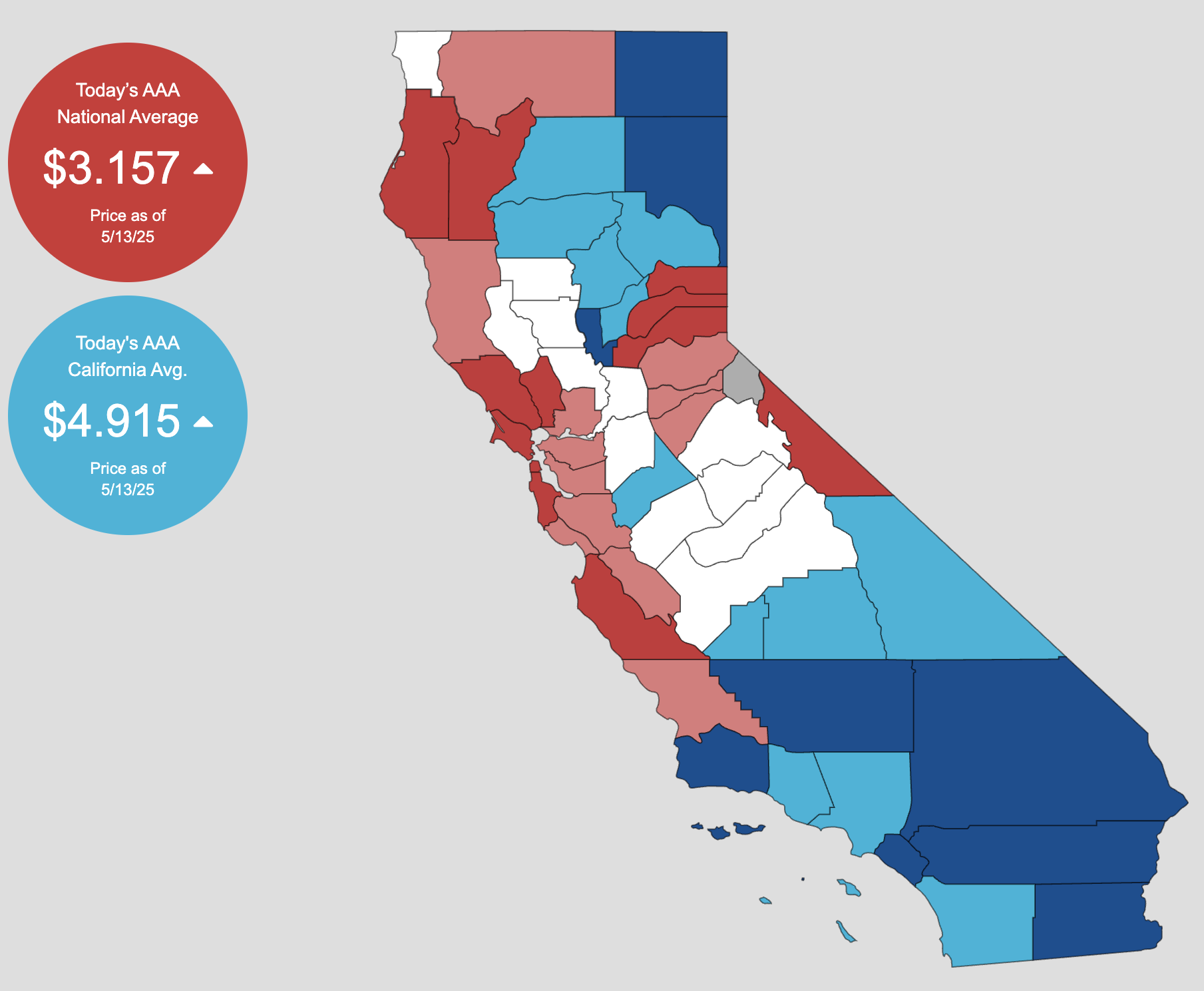

$4.915

California Average Price/Gallon

$3.157

National Average Price/Gallon

The State Profits More from Gasoline Sales Than Refiners

Data shows that the state collects more revenue per gallon through taxes and regulations than refiners earn in profits.

California’s High Gas Prices Are Driven by Taxes and Fees

Californians pay approximately $1.30 per gallon because of taxes and regulatory costs, the highest in the nation, contributing significantly to the state's high gasoline prices.

The California State Excise Tax is a Major Cost Factor

As of January 2025 the state excise tax on gasoline is 60 cents per gallon, significantly increasing the overall price that consumers pay at the pump.

Who’s Really Gouging You at the Pump?

California continues to lead the nation in high gasoline prices, with drivers paying significantly more than the national average. While politicians have repeatedly pointed the finger at oil companies for price gouging, a deeper dive into the numbers tells a different story. The real culprits behind California’s sky-high gas prices are the state’s excessive taxes, costly environmental regulations and misleading political narratives that attempt to shift blame away from Sacramento.

Government-Imposed Costs: The True Driver of High Prices

Californians pay approximately $1.30 per gallon because of taxes and regulatory costs, the highest in the country. This includes a state excise tax of 60 cents per gallon as of January 2025 and additional costs from the state’s multiple environmental mandates. Additionally, state and local sales tax of around 3.8% further increases costs at the pump. Higher costs can also be attributed to California’s strict fuel standards and unique summer and winter gasoline blends.

Collectively, taxes and regulatory costs significantly drive the price of gasoline beyond national averages. The federal government only collects 18 cents per gallon through the federal excise tax - a small drop in the bucket compared to what the state pockets.

Californians Once Again Bear The Burden

California’s high gas prices are the direct result of Sacramento’s tax-heavy, regulation-driven policy framework that artificially inflates costs. With the state having little to no say over crude oil costs, Sacramento lawmakers must shift focus to where they can actually lower prices at the pump - onerous taxes, fees and regulations that drive up costs for everyday, working Californians. And when fuel prices increase, so do nearly all other goods and services as businesses seek to pass on their costs.

With fuel costs already straining household budgets, California’s tax and regulation-heavy approach to energy pricing is exacerbating the affordability crisis.

Lawmakers must reconsider the impact of state-imposed costs on consumers and work toward more balanced policies that alleviate, rather than worsen, financial burdens.